Turn Unpaid Invoices into Cash with VoloFin

Receive up to 90% of cash against your sales invoices to grow your business

- Payment of up to 90% of invoice value - within 48 hours

- Collateral free

- Charges as low as 0.5% per month

- Credit Facility of up to $2 million

- Fully digital and swift on-boarding

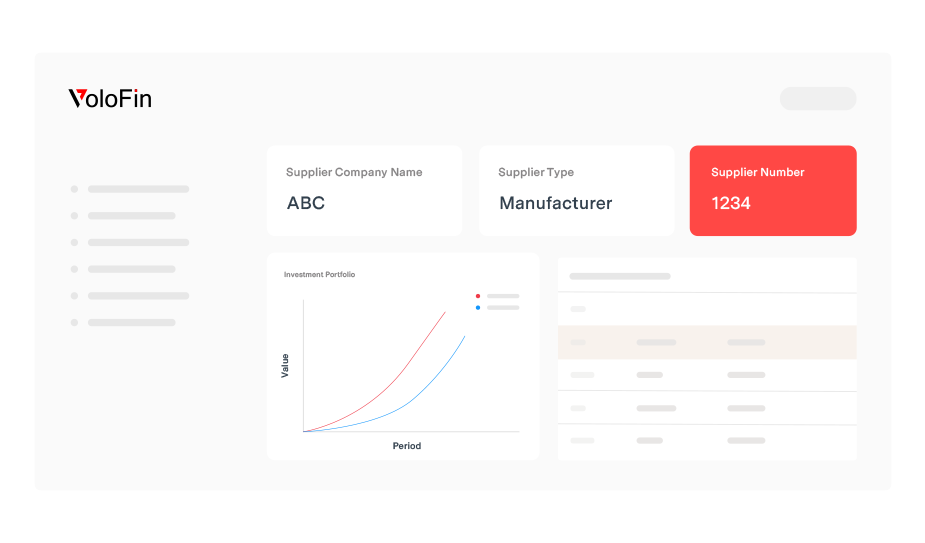

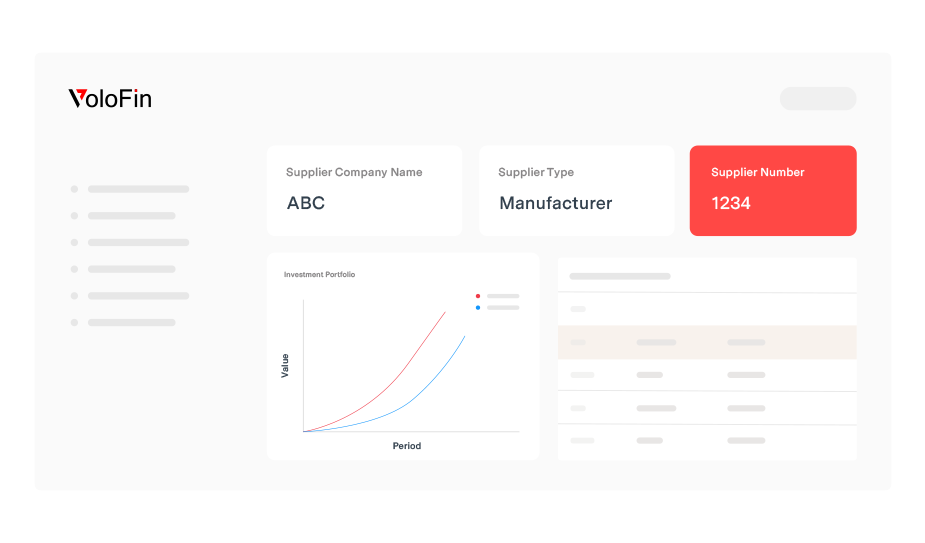

Grow your business with VoloFin

Don’t let the unavailability of funds limit your growth. Convert your receivables into cash within 48 hours.

Get paid up to 90% of your invoices - within 48 hours

It’s time to grab the chance to get paid against outstanding invoices within 48 hours or even upfront – and use your funds to grow your business in new regions with our tailored solutions.

-

Attractive terms

VoloFin’s invoice factoring is a collateral free financing option for SME’s with interest rates as low as 0.5% per month. SME’s can convert unpaid invoices into cash in 48 hours.

-

More Focus on your business

With VoloFin, you don't have to worry about delayed payments any more. We assume the buyer risk for you giving you plenty of time to focus on expanding and growing your business.

-

Fully digital

Businesses can self-onboard on the platform and conclude transactions seamlessly without any paperwork.

Why do thousands of SMEs trust VoloFin for post-shipment trade finance?

-

Fully automated self

on boarding platform -

Industry-first fully transparent platform

-

VoloFin assumes the

buyer risk -

No financials or

collateral needed

Get started

Avail collateral-free finance in 4 easy steps:

-

Apply

Online

-

Get

Onboard

-

Submit

Invoice

-

Get Your Advance

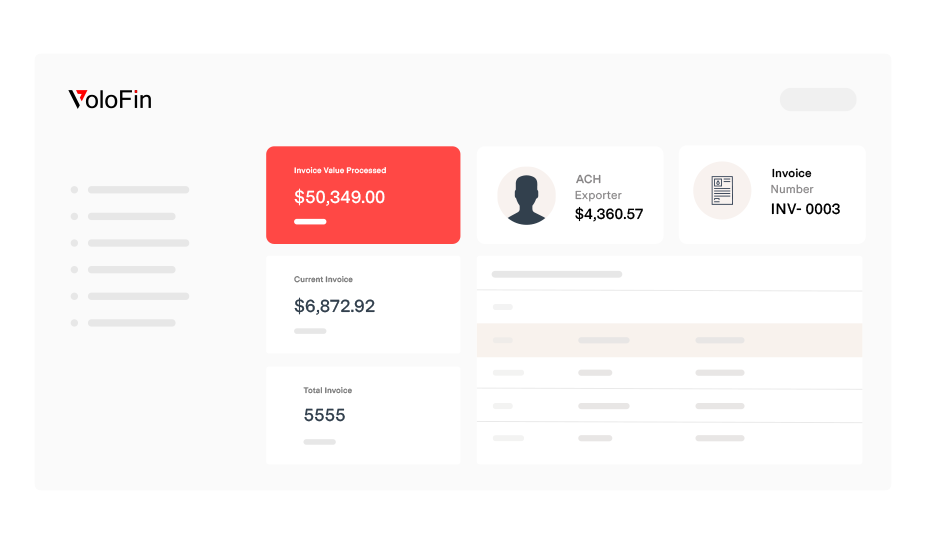

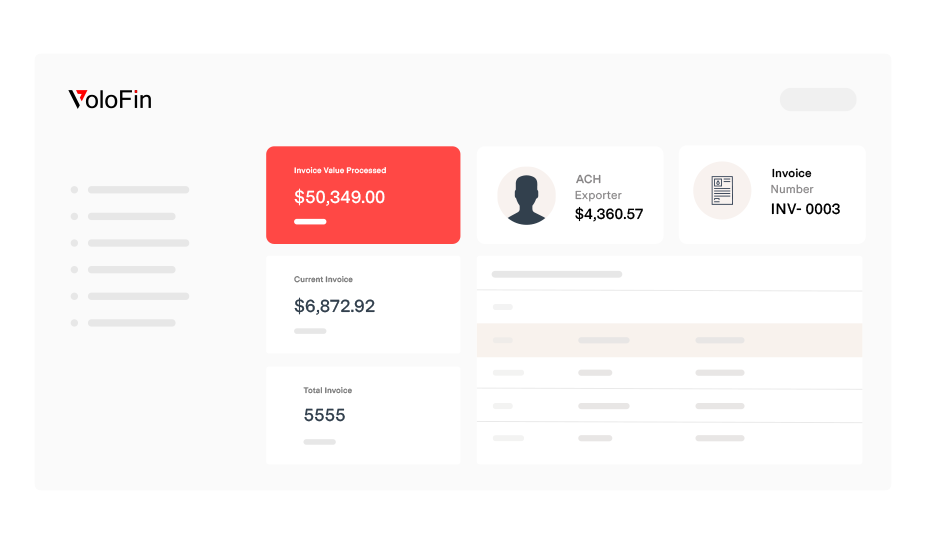

Track and manage with the state-of-the-art digital platform

The supplier portal will provide you the ability to raise a funding request against any invoice via just a few clicks.

Users will have the ability to track the status of all the transactions and related details, ensuring a transparent view of our processes.

The supplier can add a new buyer to their portfolio at any time to be digitally assessed and have a limit allotted.

VoloFin’s supplier portal acts as a one-stop solution for all your financing needs, making interactions easier & quicker.

Get up to 90% of invoice amount in just 24 hours

Frequently asked questions

Our team of experts is here to support you with the answers to all your queries. Find the answers to some common queries!

Receivables financing or invoice factoring is a revolutionary non-recourse* working capital solution oriented towards any business exporting overseas and working on elongated credit period (30 – 180 days) or if your bank limits are insufficient for the growth of your business.

VoloFin ensures a shorter working capital cycle for your business, meaning you get paid as soon as the goods are shipped and we also secure you against certain non-payment scenarios ensuring your time is spent doing what you do best and not worrying about problems commonly related to international trade like: lack of liquidity, Non-payment or collections on due-dates.

VoloFin provides easy access to working capital solutions and can extend a facility to you in less than 48hours thanks to our automated risk assessment. Once your limit is established you can get your invoices paid in 4 simple steps:

- Customer submits invoice to VoloFin

- VoloFin advances upto 90% of the invoice value within 24 hours

- Buyer pays VoloFin on due-date

- VoloFin settles the margin with it’s customer

VoloFin is a platform, this allows us to extend lines of upto 5 Mil USD* by leveraging it’s investor network. This means we’re equipped to handle working capital requirements of all shapes and sizes.

Banks have historically represented the primary source of lending for most business. However, bank limits are often insufficient for the growth of your business. This manifests itself in the form of a 109Bil USD financing gap in the Small – Medium sized industry segment. What’s more, bank limits are intrinsically linked to traditional forms of security or collateral. As a growing business, you might not want to invest in collateral further. That’s where our product fits in. Our product can either allow you to augment your current banking lines or replace them entirely while safeguarding your interests through non-recourse financing.

November 11, 2024 VoloFin Gets $50 M From A Top US-based Bank; Aims To Bridge Trade Finance Gap For SMEs | CNBC

November 11, 2024 KBRA Assigns Preliminary Ratings to volofin Finance (Ireland) Designated Activity Company and volofin Finance US LLC read More Gain

November 11, 2024 VoloFin secures USD 50 million to provide Indian exporters with optmised trade finance read More Gain access to collateral-free

November 11, 2024 VoloFin Gets $50 M From A Top US-based Bank; Aims To Bridge Trade Finance Gap For SMEs | CNBC

Fast, flexible invoice financing to

Empower your business growth

Accelerate cash flow. Free-up trap liquidity. Instant fund for exporters